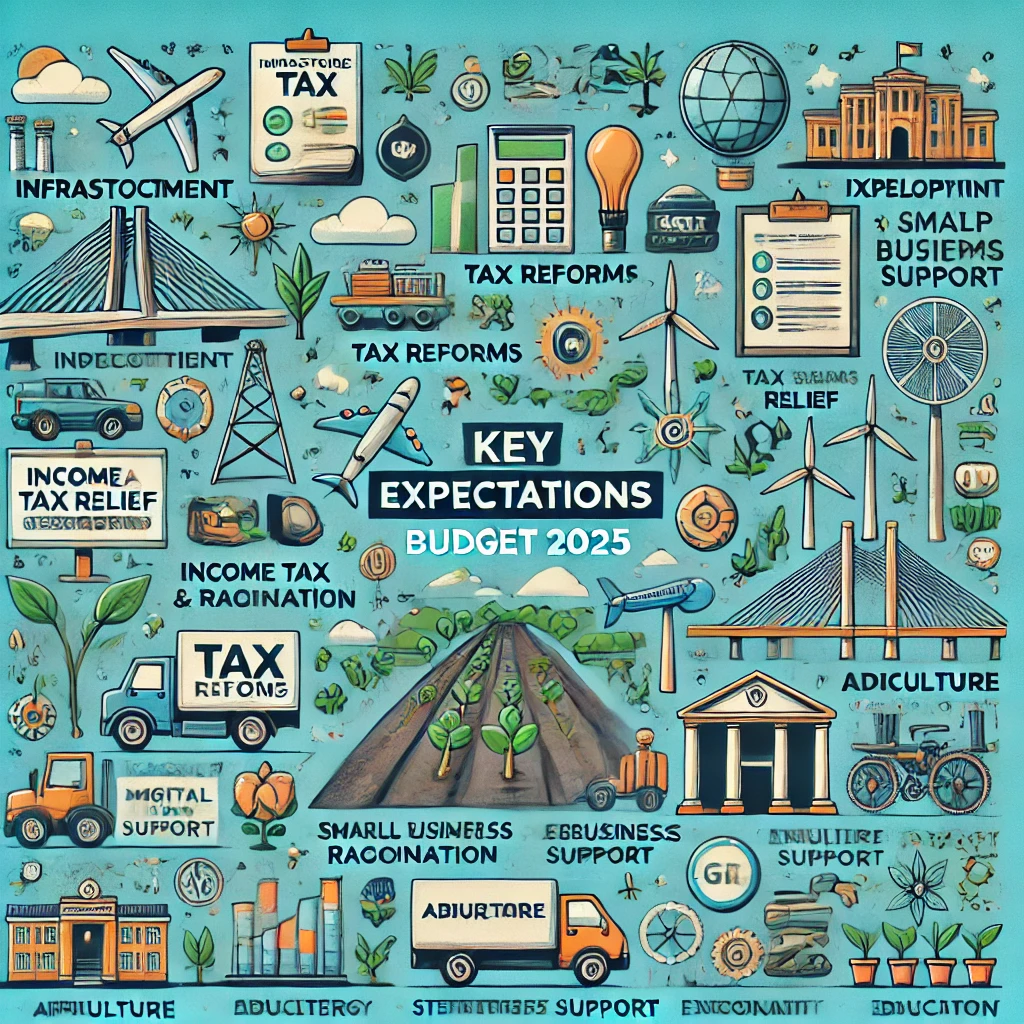

As the Union Budget 2025 approaches, expectations are running high across various sectors of the economy. With economic recovery, inflation concerns, and global uncertainties in mind, stakeholders are hoping for a balanced approach that fosters growth while ensuring financial stability. Here are some key expectations from Budget 2025:

1. Boost to Infrastructure and Capital Expenditure

The government is expected to continue its focus on infrastructure development, with increased allocations for roads, highways, railways, and urban infrastructure. Public-private partnerships (PPP) and incentives for private investment in the sector will be crucial.

2. Tax Reforms and Relief for Middle-Class

The salaried class and small businesses are anticipating tax relief in the form of increased exemption limits under the Income Tax Act. Simplification of tax laws, rationalization of GST slabs, and additional deductions for housing, education, and healthcare expenses are also on the wish list.

3. Support for MSMEs and Startups

Micro, Small, and Medium Enterprises (MSMEs) and startups are seeking easier access to credit, tax benefits, and incentives for innovation and digital adoption. Measures such as lower interest rates on loans and extended tax holidays could significantly benefit this sector.

4. Strengthening the Agriculture Sector

Farmers and agricultural stakeholders expect increased subsidies on fertilizers, irrigation, and crop insurance. Incentives for modern farming techniques, organic farming, and agri-tech startups are also anticipated to improve productivity and profitability.

5. Healthcare and Education Investments

The pandemic underscored the importance of a robust healthcare system. Increased budget allocation for healthcare infrastructure, medical research, and affordable medicines is a key expectation. Additionally, higher spending on education, digital learning, and skill development programs will be vital to equipping the workforce for the future.

6. Climate and Sustainability Initiatives

With growing global emphasis on sustainability, the budget is expected to include incentives for renewable energy, electric vehicles, and green manufacturing. Subsidies for solar power, wind energy, and battery storage solutions could drive India’s green transition.

7. Job Creation and Employment Generation in Budget 2025

Unemployment remains a pressing concern, and policies aimed at job creation through skill development, entrepreneurship support, and incentives for labor-intensive industries like textiles and manufacturing are highly anticipated.

8. Digital Economy and AI Adoption

Given the rising importance of technology, investments in artificial intelligence (AI), fintech, blockchain, and cybersecurity are expected. Strengthening digital infrastructure and incentivizing research and development in emerging tech fields will further India’s position in the global digital economy.